Big data approach in Banking system

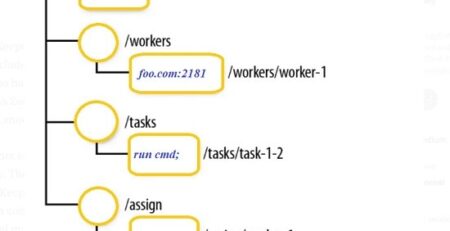

Typically Banking systems are responsible to validate and verify financial transaction data, geo-location data from mobile devices, merchant data, and authorization including submission data.

Data from lots of social media channels and Banking’s mainframe data center have a significant challenge to process and deliver final output.

Issue:-

Legacy systems are incapable of processing the data in when is in motion.

Combining all different format of data is together is another challenge like structured, semi- structured and un-structured.

Big data Approach:-

Big data analytics enables to combine, integrate and analyze all the data at once – regardless of source, type, size, or format – to generate the insights and metrics needed to address fraud and compliance-related challenges.